MonsfortCapital is no company name, but an invention based on the region, where I live, much like Mont-Sylvain is. The "Bergisches Land" region is a hilly region once governed by the counts (and later dukes) of Berg, with "Berg" being the German word for mountain. Their coat of arms was a blue-crowned red lion and the lion, of course, will form a nice mascot in financial terms denoting strength, solidity and fitness to fight. Both, the mountain and the lion, thus form my trader´s logo. The name Monsfort derives from the Latin "mons fortis", which is echoed in family and place names throughout European countries. A fortified place on elevated ground.

Having had my formative years during the 80s, there were several, sometimes conflicting, influences at work. For example, I started flirting with the Gothic Scene although it took me many years before I more openly associated myself with those romantic and independent-minded people. On the other hand, I felt drawn to the investment world. While I made some embarrassing forays into the shallow Yuppie way of dressing, what really fascinated me behind all this pastel-coloured nonsense was the idea of independence.

Basically, you can sit at home in your pyjamas and do your research and come to lonesome decisions. The quality of which, of course, will be decided upon by that strangely whimsical and powerful machine out there, the Market. In all money matters it seems advisable to speak to as many people as possible and have your opinions tested again and again. It is a continuing process of learning and, over the years, you develop a system of where to look for what and when to listen to people and when not to listen to them. You don´t have to be an investment banker to do it and the only job interview you have is the daily development between green and red of the figures on your computer screen. I have grown rather fond of this.

A second aspect I like is the research. Naturally, it incorporates reading balance sheets and trying to gauge a company´s possibilities through figures, which is a part most people don´t like. Actually, I see this as a mere technical part of the job that has to be done as well as possible. The more interesting part for me is something that I think is very much like sound journalistic work. It is about trying to form a model extrapolating from the present into the future, a model that has to have certain ground lines while at the same time being flexible enough to adjust to unforseen changes. Doing this on the level of a single company, an industry or the economy as a whole is another 3D chess game and, of course, quite a huge task, for which I can´t really claim being knowledgeable enough. But as the motto of Carlsberg A/S states: "semper ardens".

I have been talking so far about "investing", which I see as opposed to "speculation". I found out very early that I am not interested in buying shares one day to sell them the next. I always liked the idea of owning a share in a company. As, for lack of adequate firepower, I have mostly been dabbling with investment funds and not direct share ownership, I always loved looking at a fund´s portfolio and trying to get to know the single companies that I now owned a microscopic piece of. But there´s also a saying: Never fall in love with the companies you own shares in. I find this very hard to do and it has proven again and again to take a huge bite out of my performance.

Still, I try to follow the school that´s called Value Investing. Although I do have to put a big stress on "try". Maybe another point that fascinates me about this particular way of doing things is that people like Warren Buffett and Charlie Munger have developed a style that transcends mere business decisions but also holds lessons for other parts of life. Thus, I sometimes see them as Zen Masters or Yedi Knights doing things or not doing things as a result of a process born out of silence. This really gets me.

If I had put my money where my mouth is, I would probably not find it so hard to renovate my house these days. As things are, however, all my "investment" endeavours have simmered on a very small flame. Luckily, "social trading" has come along and offered a playground for penniless would-be investors like me. Naturally, I was quick to invent a flamboyant trader name. As a result you can have a look at how MonsfortCapital is bungling along on: https://www.wikifolio.com/de/de/p/monsfortcapital (please read the legal comments on www.wikifolio.com as to the nature of social trading and possible related products).

I also set up a corresponding facebook site, which I use to post some articles and links of things I´m currently occupied with: https://www.facebook.com/MontSylvain.eu/

There are two more things I would like to mention before we look at my views in more detail. As stated in the "legal notice", I can only advise against doing anything I positively comment on (although I´m not allowed to advise anything which has to do with financial matters). The second thing is about ethical and environmental concerns. Throughout this website you might have seen that both issues are important to me. While I have used ethical-environmental investment funds for a number of years, I´m no longer convinced that this approach (alone) satisfies me. For a number of reasons. One, for example, is that I believe that precious metals and the mines producing them are absolutely necessary parts of a future-oriented portfolio. And those companies can´t excactly be called a boon for the environment. While I do have a blacklist of companies and industries I don´t invest in, quite a number of portfolio positions I hold wouldn´t make it into an environmentally responsible fund. This is still an ongoing internal discussion I have with myself and a contrast to many links and topics on this website.

With that out of the way, here´s my investment process. As mentioned, I don´t trade (or let´s say, very rarely). I try to identify undervalued investments or great investments at a fair price. And then I try to hold them for long periods of time. The process consists of four elements. Quantitative Analysis refers to accounting questions. Reading balance sheets and looking at various numerical parameters. Qualitative Analysis seeks to identify an investment´s position in an industry, a market, and with respect to very ideosyncratic topics such as the management quality and their approaches to capital allocation. Macro Analysis covers all things going on in the broader economy and the political sphere. Interest rates and wars do play a role. Some value investors often state that they don´t care for macro factors. This is understandable as looking at macro factors might lead to market timing efforts, which is mostly a bad idea. Still, some renowned investors seem to have an eerie penchant for making the right decisions at the right times, even while allegedly avoiding market timing. The larger trends, in my opinion, have to be taken into consideration. Psychology is the hardest part of investing. It involves observing the psychology of others, or the „psychology of the crowd“. But, more importantly, it refers to one´s own psychology. Once you have bought an asset, your brain never ceases to make you sell it. If it´s down, your brain wants to sell it; if it´s up, your brain wants to protect profits and urges you to sell. Mostly, those two impulses are detrimental to your investment performance. Instead, you need to have a rigorous plan for each investment position. And you need to follow it without emotion. Over a long period of time. „Fear is the mind-killer“ is a line in the „Dune“ series of books. And boy, it is. Big time. And I know a thing or two about fear. |

|

Amateur investors largely concentrate on only two of these four elements: Qualitative Analysis and Psychology. But they do so in a twisted way. Qualitative Analysis for them comes down to narratives. The latest craze is what they focus on. The stampede of the crowd. Psychology comes down to „FOMO“, fear of missing out. Leading them to buy overhyped, and often mostly worthless or largely overvalued investments. They follow the crowd, while professional investors are selling them their positions at a profit, which they have bought long before the craze started. This repeats over and over again.

The ideal investor is a Buddha, Yedi or Zen-Master. They sit in a corner of their room with their eyes closed. They monitor and process. They control their emotions. And shadows and lights pass through their perception. Eons pass without them stirring. Then, on The Cue, they open their eyes. They spring to action with uncanny speed. In the dead of night, without anyone knowing. They act. And then they go back to their corner of the room and close their eyes. And wait. A spider in the centre of a meticulously woven net. Waiting. „The money is in the waiting“ Charlie Munger said. This is my chosen path.

What is The Cue ? Charlie Munger says that you should move only, when you have an advantage. As is often the case with Value Investors´ advice, it says rather little about the application. The devil is in the details, as usual. It might mean having an informational edge. But then, millions of professionals with more brains and computing power than I can dream of will beat me to it every time. It might be different with situational anomalies and smaller companies. Let me give you an example from my own investing practice. I bought shares in a small to mid-sized European company a few years ago. The nation the company is domiciled in then decided that it would be a good idea to tax profits far more than before. The share price plummeted about 30 % in a day. That´s when I bought more. In an instant. Without doubt. As I´m writing this, about one and a half years later, the share price has fully recovered and even gone beyond that. It has long been my firm conviction, that investments should never be based on tax considerations (or currency considerations, for that matter), but on an asset´s quality only. Tax regulations change all the time, and this has nothing to do whatsoever with the asset itself. Eons will throw light and shadows into your room, which will all come and go like the seas. Quality will prevail, influences from outside will offer opportunities. I´m not saying that contrarian viewpoints always mean that you will have an advantage. Pick your contrarian bets as carefully as any others. But in this particular case, the situation and the movement of the herd gave me a window of opportunity. Maybe that´s what Charlie meant. Of course, this means a constant vigil, monitoring, and ongoing analysis. Thinking and relentlessly questioning one´s thoughts and findings. Hard to do.

Let´s think beyond single positions and, instead, about a portfolio as a whole. Value Investing proponents always say that you should have a concentrated portfolio. Critics have often said that you should not listen to what Value Investors say, but to look at what they do. I´m afraid, there´s some truth in that. At one point, Charlie Munger only held four positions in his personal portfolio and commentators fell over each other citing this as the epitome of wisdom. I´m dumb (or bold) enough to disagree. Two of these positions were Berkshire Hathaway and Li Lu´s investment fund. Both of which hold more than a hundred of entrepreneurial engagements, taken together, many of them listed and others unlisted. That is not a small number of positions. I do get it, when Warren and Charlie and other investors hail the advantages of a concentrated portfolio. But, even when you build such a portfolio, it will be a full-time job, because finding those stellar few will take time and effort and constant in-depth care. Definitely not for an amateur investor. It is for these reasons that, personally, I try to build a portfolio that has some resilience built into it to deal with changing market situations and to account for several long-term trends. And, above all, to account for my own errors. Which means, as I´m writing this, that I hold more positions of various securities than the twenty to thirty rule-of-thumb many value investors put forward for a stock portfolio. With some of these being funds of various sorts with their own broad array of investments. I´m not fishing with a fishing line or two, but with a carefully woven net. To borrow an analogy from Diego Parrilla, you need offensive and defensive players on your football field to account for the vagaries of time. These give you resilience and leeway to act when others can´t. Let´s explore the portfolio idea some more.

| While I´m very interested in shares as individual investments and also other investment variants, I have been wrecking my brain for quite some time about designing the "Perfect Portfolio", which means answering the question of how do single investments move against each other within a portfolio to create, ideally, additional return. Of course, everyone does that, and there are many approaches. Here´s my own interpretation: The Peregrine Portfolio. Which, of course, refers to the falcon species of that name. The Peregrine Portfolio is a Permanent Portfolio based on the work of Harry Browne. The basic tenets of Harry Browne´s portfolio are that the future can not be predicted and that a fixed diversification across asset classes, which should be upheld at all times, protects against unforeseen developments. Browne´s classic allocation calls for 25% in stocks, 25% in gold, 25% in bonds (long-duration bonds) and 25% in cash (short-duration bonds). This allocation is aimed at performing equally well during the four economic conditions of prosperity, inflation, deflation and recession or possible combinations. |

My variant, however, changes a few things about this idea. Actually, no matter what flamboyant name I invent for my portfolio, it is very close to what a person using the pseudonym Tyler proposed on https://portfoliocharts.com/. Tyler´s portfolio is called „The Golden Butterfly Portfolio“ and my own Peregrine is a blend of that approach with Harry Browne´s portfolio. To some extent. So, to be very clear about this, my portfolio is more Tyler´s and Harry Browne´s brainchild than it is my own. If you´re interested in portfolio composition, Tyler´s website is an absolute must-go-to. It is visually and theoretically clear and fascinating. Still, I made some changes to these time-tested approaches.

Through the weekly podacst on https://www.macrovoices.com/ I first heard about Chris Cole´s work at Artemis Capital and his research on permanent portfolio approaches. You can find his work here: https://www.artemiscm.com/welcome#research „The Allegory of the Hawk and Serpent“, which you can download from that source, strengthened some misgivings I had long held about the current financial era drawing to a close. With lots of turmoil lying ahead. Based on my own attempts and the Artemis Capital research, I decided to use (long) volatility as well as trendfollowers in place of cash. Also, I chose an ETF for the bond section, which covers global bonds of all durations and doesn´t concentrate on a specific duration or region (currency).

Most permanent portfolios work with three or more asset classes and allot differing portions. I want to take several steps back and try for a very abstract view to address the question of which assets to include. For me, the starting point is money. What can you do with money ? You can hoard it, you can spend it and you can lend it. Also, you might consider spending some of it on insurance to safeguard all of the other three. So, here we already have our asset class definitions. Spending, lending, hoarding and insuring. These would translate into stocks, bonds, gold and alternative approaches. Another way of looking at this portfolio would be to concentrate on abstract aims, that this, or a vaguely similar allocation, could reach. These are productivity, continuity, independence and liquidity. These points could align with the asset classes I use, but actually I see this approach as a kind of superordinate level of viewing investments, with all assets realising these aims to a greater or lesser degree. Admittedly, productivity is the central factor here, and gold and alternative assets will be rather hard put to make a claim to achieving this aim. Yet, they are strong in the other three aspects respectively.

With these abstract considerations in mind, there should also be a set of rules for the portfolio alongside the asset definitions and their distribution. First, I want the portfolio to be as liquid / fungible as possible, meaning that it should be possible to change or liquidate it with a few mouseclicks at any time. Second, I want it to be as internationally actionable as can be, which means no positions which only work within a single legal environment or are specifically tied to a special fund company. Third, and this is a rule used in almost all permanent portfolio approaches, no market-timing or shorting of securities (admittedly, the alternative asset positions might use shorts within their strategies, but only to realise the overreaching long-volatility target). Forth, I want to be in control of what I invest in; this means using ETFs, which realise the various asset representations as closely as possible, and where a degree of management is only included by maintaining the distributions as defined by the indices. And fifth, a recalibration should be independent from a timed schedule and should only be done when an asset sector diverges more than 5 % from the set quota, where the 5 % are meant in portfolio-terms, not with respect to a single position. For example, if gold soars and uses up 30% or more of the total portfolio, that might be a good time to prune it back to its 25 % portion and use the money for the less successful assets.

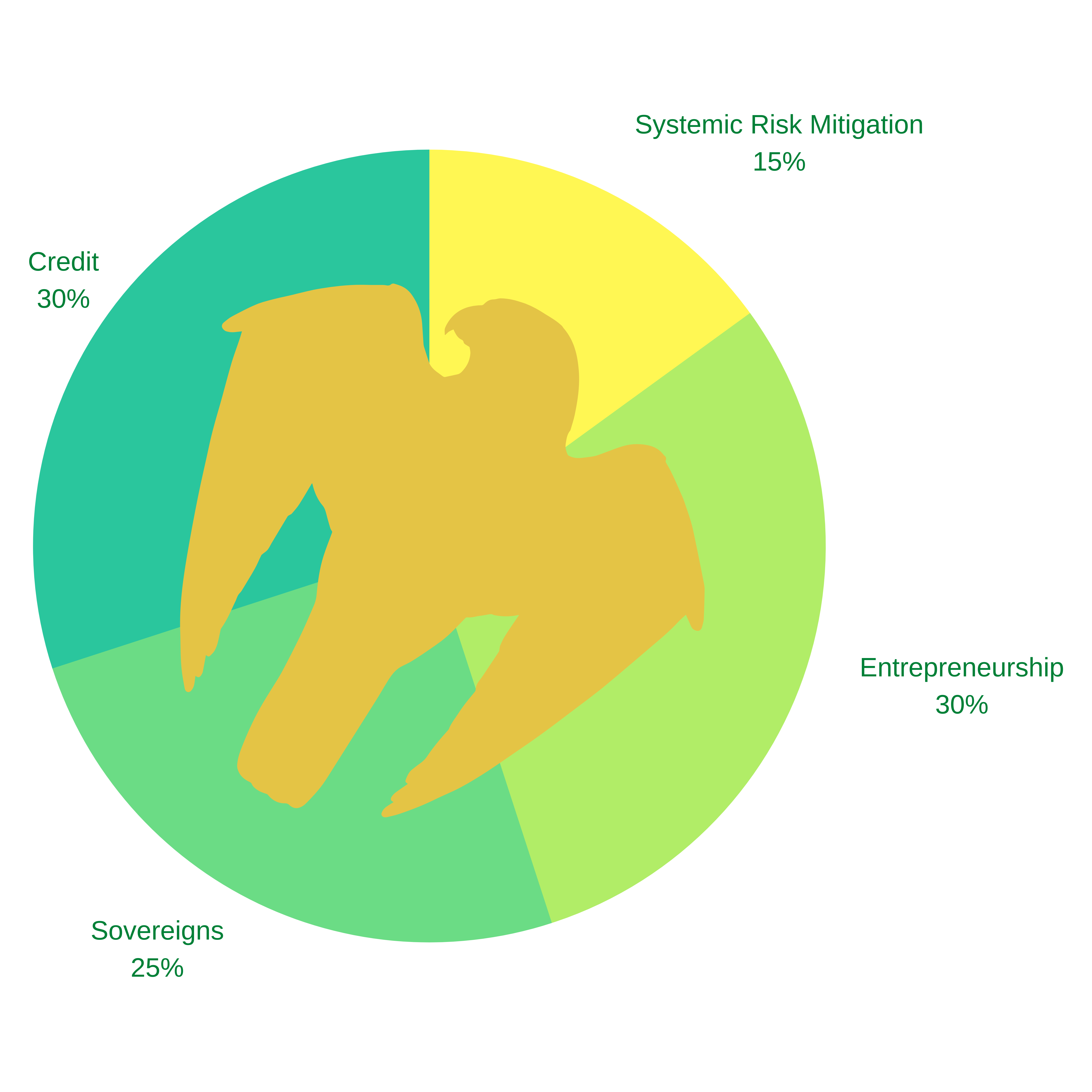

I have chosen different section headers as time progressed to allow for alternative viewpoints. "Entrepreneurship" refers to the share section, but might also include direct investments in businesses as well as Web3-possibilities of owning a share in the success of particular projects. "Credit" likewise refers to all options of having value generate yield by lending it out. "Sovereigns" refers to all investments, which need no or only a small amount of vindication of their value by outside parties; beyond precious metals, this could encompass land, art and Bitcoin. "Systemic Risk Mitigation" is devoted to long volatility and trendfollowing approaches, thus moving the portfolio closer to Chris Cole´s original suggestion. Trendfollowing, however, does fly in the face of the long-only approach of the Permanent Portfolio as it might mean shorting various assets at times and doing so as decided by a fund management team or algorithm. Tyler uses a 40% portion for shares („spending“). I really like that, because I feel that investing mostly centres around putting money into good businesses. Which includes, by the way, real estate. I would much rather opt for holding (liquid) real estate shares than physical burdens. Actually, I try to design the portfolio with as much regard to liquidity and international interchangeability as possible. Who knows, maybe I will emigrate to Sweet Alba after all. However, while shares have done well during roughly the last three or four decades, longer time periods paint a less favourable picture. Consequently, although with a heavy heart, I eventually restricted myself to a 30 % allotment only for shares. While I do have problems with a large bond section, as in Harry Browne´s approach, I still think that there are enough reasons not to prune it to too small a share. Being very concerned about the possible developments in the money value and currency fields, I still have to acknowledge that the past seems to deliver one or two arguments in favour of bonds. Especially, considering some of the possible economic environments, which seem to offer surprisingly positive development possibilities for bonds. Allowing for "spending" and "lending" to be the two main avenues for investing, I found it reasonable to have these two as the "wings" of my portfolio. The falcon has then a broader tail in the precious metals (falcons spread out their tail feathers in some flying movements) and a sleek head with the alternative asset section. Finding the right proportion for alternative assets, consisting of long volatility and trendfollowing, has been quite hard for me as the volatility portion tends to fluctuate quite strongly over time. There might be very long periods of low volatility like the years between 2013 and 2020, which might result in a very poor performance of this section and thus a considerable drawdown for the whole portfolio. On the other hand, limiting it to a very small portion would have it develop too little thrust during emergency periods. Also, long volatility reacts favourably to sudden crashes, while trendfollowers can work positively against slowly decaying movements. Thus, all velocities of negative developments should be accounted for. An allotment of 50/50% within this 15% portfolio section might be a satisfactory approach.

The share section, however, is still central to my considerations, which also means that I prefer smart-beta ETFs over broader approaches, which might not be satisfactory in quality terms. This means that the stock portion has two components: quality and megatrends. For quality, I use a dividend as well as a value ETF. This could be, for example the FTSE High Dividend Yield index for the dividend position and a value-oriented ETF, as there are on offer featuring value factor approaches regionally or globally. The thoughts about megatrends are a bit more complicated. One of the most important fascinations of spending time with financial markets is that they try to look into the future. For me, this is the „journalistic“ component of analysis alongside the accounting portion of work needed to set up and maintain a portfolio. Once you allow for that, megatrends tend to crop up everywhere. Some of them might have legs, the invention of others, however, might be motivated by mere marketing considerations. I see only two „true“ megatrends, however: Science Fiction and the Middle Ages. In my view, advanced technology as well as oldfashioned stuff like real estate, precious metals and agriculture are the places where I want to put my money.

A pandemic like COVID-19 is an external occurence, the likes of which will happen repeatedly over time. It simply can´t be planned for. But there are two negative developments, which are clearly visible on the horizon and which, in my perception, are still not adequately factored in within most portfolio allocations. These are climate change and the conglomerate of problems arising from debt excesses and money debasement. The first, at least to some extent, can be tackled by the Science Fiction megatrend, the second, by the Middle Ages megatrend mentioned above. Also, the shift towards a digital economy accelerates by the minute, which makes the Science Fiction investment obvious.

In oder to keep position numbers down, one ETF for each of the two topics is part of the portfolio. A technology ETF, maybe something like the Nasdaq-100 index or the Lyxor MSCI Disruptive Technology ETF, alongside a very medieval choice like the Arca Gold BUGS index. Instead, you might also want to consider timber, agriculture, REITs or infrastructure. A natural resources or materials ETF might also be a good choice as it might cover a large range of "medieval" assets. This gives us four positions for the stock portion and one to two positions each for the remaining sections. These are more than enough, considering that you have to readjust positions over time or might be forced to withdraw money, if your personal situation so demands. It might also be noteworthy that I try to prefer ETFs for the stock and bond allotments, which pay out dividends / interest in order to have the portfolio also be a source of income if need be. Although, I do realise that it might need upwards of a million fiat currency units invested in the total portfolio to generate a semblance of a halfway meaningful income stream. Maybe, in old age, rolling over the other share portions into the dividend fund might be an approach to make the portfolio more conservative as well as more income-yielding.

The "secret sauce" of every permanent portfolio is that you hold the asset allotments steady over time by recalibrating. This means, essentially, that you sell stuff expensive and buy stuff cheap. You can give this an additional kicker by doing so during extreme market situations. The more a market crashes, the better. Volatility is your friend. Not only because of the volatility portion, but also because all the sectors will move against each other up and down over time and recalibrating means reaping a volatility arbitrage on all of them. Another nice feature of this is that you don´t try to time the market, you react to it. And you do so within a quantitative frame, largely free from human error. This is the true magic of the permanent portfolio.

The portfolio should reflect your financial means. Obviously, you could limit yourself to a small number of investment funds / ETFs only, corresponding to the four asset classes. You might instead want to stay closer to Tyler´s portfolio and use a broad stock index alongside a small cap ETF for the stock portion. By the way, this is something Harry Browne already alluded to; so the share section of his approach would also be allowed to be a bit more differentiated instead of just using a general index like the MSCI World. The positions mentioned above are already an advanced level of building your investment castle. If your financial firepower allows you to take things even further, you could, of course, consider adding some direct stock positions to complement the ETFs. Preferably in a value-oriented buy-and-hold manner. Just mentioning.

It should also be noted that despite using "passive" investment instruments, the portfolio will still need some attention now and then. It is not for the hyper-active trader and it is also not for the passive "invest & forget about it" investor. Beyond that, making up your mind about the stock portion, maybe thinking about value and megatrends or some other distribution more promising to you, all of that requires some knowledge and effort. And, as you can see from the preceding paragraph, this can still be scaled up.

In my opinion, the best way to put money into the portfolio is by making regular purchases. Especially the volatility portion thrives on the cost-averaging this brings along, which is due to its high price differences over time.

The inclusion of cryptocurrencies into this framework might also be something to be considered. The underlying technology of distributed ledgers / blockchains will surely transform many areas of our organisational life, specifically where sensitive data are concerned. This relates to the finance industry, but also to all kinds of governmental and related areas of activity such as registries. The Internet of Value is here and will complement the existing Internet of Information and mobile apps. Beyond, the trajectory will further stretch into such esoteric fields as the Metaverse and might incorporate AI elements.

Basically, most of these changes should be investable through shares of companies active in these fields. Yet, cryptocurrencies are addressed as a new asset class in their own right. I´m a bit wary when it comes to making such a fundamental claim. However, „cryptos“ seem to combine features of currencies and features of ownership rights to some extent, maybe even features of bonds through staking and lending. Owning a cryptocurrency consequently means owning a part in the success of the respective network / blockchain. In my view this invalidates the argument that cryptocurrencies are inherently worthless, because they express the perceived value of the network´s use cases and acceptance. However, it´s still very early days to proclaim one or two cryptos as eventual winners for the rest of recordable history. At least in my view. Beyond cryptocurrencies such developments as non-fungible tokens and DeFi (Decentralised Finance) will also be needed to be monitored as possible investments.

Cryptocurrencies have developed in a grass-roots-movement and have often been derided by established incumbents. That outside perception seems to be slowly changing. Possible regulation and competition from governments and corporations will define the future environment for blockchains and cryptocurrencies. It remains to be seen, if a „decentralised“ finance system will be allowed to thrive or if it even will be able to stand its ground against all odds. It also remains to be seen, where Silicon Valley will take its stand within this development. Clearly, an investment into cryptocurrencies must be seen as highly speculative, specifically if a decision is to be made in which currencies and projects out of the large number existent that investment should be made.

One way of playing this would be to invest in companies and hold your crypto seperately from your investment account in cold storage. Very much like the option of holding precious metals physically and not via a financial product. If you do want to use a financial product for your cryptos, however, you might consider a solution that holds the 10 or 20 largest cryptocurrencies at all times, similar to an ETF. This would do away with the need to make commitments to specific coins and let the fund company see to you having the currently most successful cryptos in your portfolio. I would see this particular solution as part of the share section. With regard to Bitcoin as the most decentralised currency so far and it displaying some quasi self-sovereign traits like precious metals, this choice might be debatable. Still, the altcoins in such a crypto portfolio aimed more at entrepreneurial use cases might justify that choice. In the future, this investment choice might be a real ETF, while at the moment it is available only through ETPs or tokens. Further into the future, bond-like crypto investments might be another option. There already exists a crypto volatility index in a tokenised form, which might be a consideration for the volatility sector.

In the end, maybe, the whole investment spiel might run on blockchain rails anyway.

There are, of course, quite a number of questions arising from all these deliberations. For the sake of this website giving an overview only, I will so far stick to outlining just the broad groundwork needed to fly the Peregrine.

There are people, who say that investing is a science and an art, which is right down my alley. It´s a passion.

My passion.

The text on this subpage of the mont-sylvain.eu website is to be seen as personal opinion only and should not be understood as financial advice.

Markus Kalter shall not be held liable for any losses incurred by a reader´s decision to have these views influence his/her personal finances.

Always consult a certified financial planner or advisor before making financial decisions.

Always base your financial decisions on broad and deep research over time as well as on hearing many opinions, viewpoints and suggestions.

Der Text auf dieser Unterseite der Internetseite https://mont-sylvain.eu ist eine persönliche Meinungsäußerung von Markus Kalter und stellt keine Finanzberatung dar. Markus Kalter ist nicht verantwortlich oder haftbar für Verluste, die gegebenenfalls aus der Entscheidung resultieren, die hier dargebotene Meinung als Grundlage finanzieller Entscheidungen zu verwenden. Konsultieren Sie unbedingt einen zertifizierten Finanzberater vor dem Fällen von Entscheidungen zu Finanzthemen. Basieren Sie Ihre Finanzentscheidungen grundsätzlich auf gründlicher und langer Recherche sowie ergänzend auf dem Einholen weiterer Meinungen, Standpunkte und Vorschläge.

Please also read the additional notes regarding financial statements here / Bitte lesen Sie auch die ergänzenden Bestimmungen hinsichtlich von Investmentaussagen hier: https://mont-sylvain.eu/legal-notice-data-protection/